are salt taxes deductible in 2020

IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. The salt deduction is only.

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

The bill landed in front of the US.

. More recently in 2021 it was brought up again to increase the 10000 limit. IRS Approves SALT Workaround for Pass-Through Entity Notice 2020-75. The Tax Cuts and Jobs Act.

Some states have been looking for a workaround to enable. During initial talks about tax reform the SALT deduction was almost eliminated. 9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state laws that shift the tax burden from individual owners to the business entity.

Simplify Your Taxes And Your Life. November 11 2020. Are salt taxes deductible in 2020.

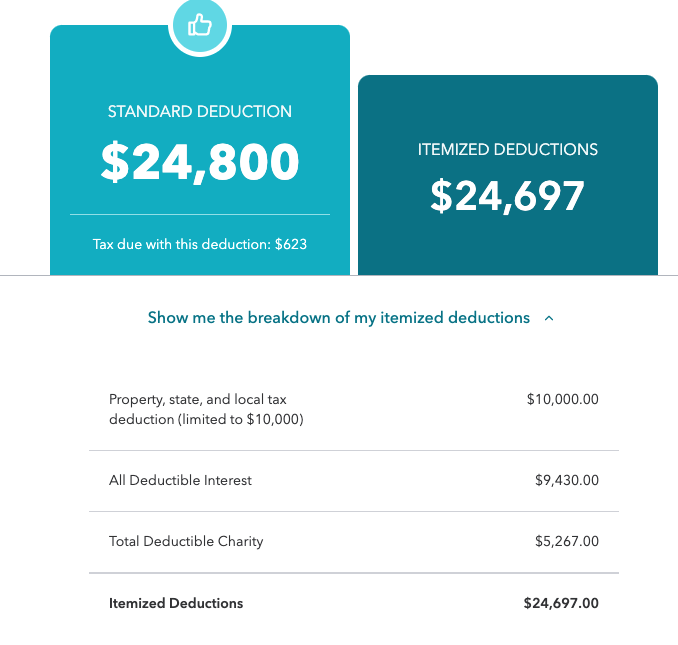

TCJA limited the individual SALT deduction to 10000 for taxable years 2018 through 2025. 52 rows The SALT deduction is only available if you itemize your deductions. The Tax Cuts and Jobs Act of 2017 TCJA limits an individuals deduction for state and local taxes SALT paid to 10000 5000 in the case of a married individual filing a separate return.

Senate in early 2020 but has not yet received Senate approval -- and whether it ever will is up for debate. After all partners or shareholders might otherwise have to reckon with the Sec. Notice 2020-75 applies to payments of.

In legislation passed only with Republican support it was designed to limit the tax benefit to states that imposed high taxes primarily Democratic states. Those in favor of limiting the SALT deduction argue that doing so avoids a scenario where the wealthy get an unfair advantage. As a result state and local income taxes whether mandatory or elective will be deductible at the level of the PTE and not passed through to individual partners or shareholders of the PTE who are subject to the state and local tax SALT deduction limitation that applies to individuals who itemize deductions for federal income tax purposes.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. Tucked away in the bill is a measure that will reinstate the so-called SALT itemized deduction for 2020 and 2021. The 10000 state and local tax deduction cap was enacted as part of the Tax Cuts and Jobs Act in 2017.

The limit is also important to know because the 2021 standard deduction is 12550 for single filers. It also aims to double the SALT deduction to 20000 for married couples filing jointly in 2019. In proposed regulations released this week the Department of the Treasury and the Internal Revenue Service IRS have signaled their intention to bless one type of state workaround for the 10000 State and Local Tax SALT deduction cap.

The SALT tax deduction is a handout to the rich. It should be eliminated not expanded Christopher Pulliam and Richard V. This will leave some high-income filers with a higher tax bill.

By Adam Sweet JD LLM. Starting with the 2018 tax year the maximum SALT deduction became 10000. Entity-level taxes that allow owners of pass-through business es to pay.

If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers. Starting with the 2018 tax year the maximum salt deduction available was 10000.

After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid.

13 hours agoSince the 2017 tax reform bill capped state and local tax SALT deductions legislators in high-tax states from New Jersey to Minnesota have ratcheted up rhetoric against supposed moocher. The SALT deduction cap. There was previously no limit.

IR-2020-252 Before TCJA individual taxpayers normally could deduct all state and local taxes SALT as itemized deductions. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025. IRS permits SALT deduction pass-through workarounds November 13 2020 The IRS released guidance on Nov.

November 17 2020 Article. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. File With Confidence When You File With TurboTax.

The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns. Fast And Simple Tax Filing. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

Ad Get Your Taxes Done Right Anytime From Anywhere. By adam sweet jd llm. Reeves Friday September 4 2020 The politics of tax policy can be as hard.

As a result of this legislation the SALT deduction has been reduced. In response some states passed statutes allowing businesses that pass through income to their owners pass. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020.

5377 which calls for the removal of the salt deduction cap for the 2020 and 2021 tax years.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Repeal Of The State And Local Tax Deduction Urban Institute

How Much Is Your State S 529 Plan Tax Deduction Really Worth

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

Learn More About A Tax Deduction Vs Tax Credit H R Block

3 Itemized Deduction Changes With Tax Reform H R Block

Beating The Standard Deduction With Strategic Giving

Most Commonly Used Tax Deductions For 2020 And 2021 Financial Finesse

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

New Limits On State And Local Tax Deductions Williams Keepers Llc

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Itemized Deduction Who Benefits From Itemized Deductions

What Is The Salt Deduction H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions