total property tax in frisco tx

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The combined tax rate is a combination of an MO tax rate of 09429 and.

6955 Single Creek Trail Frisco Tx 75035 Mls 20067703 Coldwell Banker

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For.

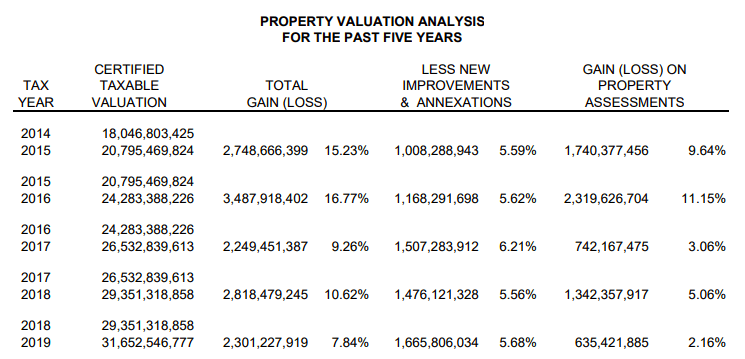

. On a 400000 home a difference of 050 means a difference. Property tax rate for city of frisco a tax rate of 0446600 per 100 valuation has been proposed for adoption by the governing body of city of frisco. The tax rate is a published amount per 100 as a percentage that is used to calculate taxes on property.

Total property tax in frisco tx Monday July 25 2022 Edit. Home in property total wallpaper. Total property tax in frisco tx.

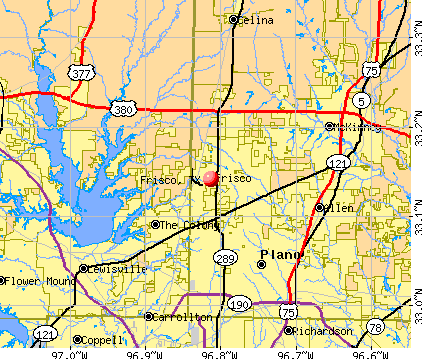

Market Rent Estimator. Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map. And then the tax rate went down just a little bit.

Collin County Tax Assessor. Frisco Tax Rates for Collin County. The median property tax in Collin County Texas.

Here is some information about the current Frisco property taxes. City of Frisco Base. Taxing entities include Frisco county governments and.

Property taxes are a major funding source of local services including public schools community health services and city services such as fire and police protection. When added together the property tax. According to the tax code a homeowner must pay an additional 87 cents in taxes for every 100 in taxable property value.

Ad Get In-Depth Property Tax Data In Minutes. Start Your Homeowner Search Today. Property taxes in Texas are ad valorem meaning they are based on the 100 assessed value of the property.

View affordable rental at 7551 Tournament Rd in Frisco TX. Free registration gives you access to all property. Start Your Homeowner Search Today.

See Property Records Tax Titles Owner Info More. The 2022 adopted tax rate is 12129 per 100 valuation 543 cents lower than the 2021 tax rate. Search Any Address 2.

The formula for calculating your annual tax bill is tax rate multiplied by taxable value. So Fresco gave fifty-six thousand dollars exemption for this being our primary residence that they werent taxing us on that amount. Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded.

Ad Get In-Depth Property Tax Data In Minutes. Search Any Address 2. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes.

Collin County Tax Assessor-Collector Frisco Office George A. In Dallas the highest property tax rate is 193 while. 1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of.

There are three basic phases in taxing real estate ie formulating mill rates estimating property market worth and receiving receipts. Those property owners living in Denton County will still receive 2 statements. Browse details get pricing and contact the owner.

Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year. See Property Records Tax Titles Owner Info More. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

Furthermore some areas include special assessments for community colleges or for fresh water districts or other utility districts.

Frisco Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Texas Property Tax Calculator Smartasset

Frisco Commerce Center Building D 6644 All Stars Avenue Frisco Tx Industrial Building

Dfw Property Taxes Expert Advice Real Solutions

Frisco Recommends Raising Property Taxes Texas Scorecard

Budget And Tax Facts City Of Lewisville Tx

The Language In A May Vote To Lower Texas Property Taxes Is So Confusing That It S Incomprehensible

Dfw Property Tax Rates In Dallas Fort Worth Texas

7170 Dreammaker Way Frisco Tx 75035 Realtor Com

Pisd Adopts Same Tax Rate For Fifth Year In A Row Plano Star Courier Starlocalmedia Com

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Frisco Recommends Raising Property Taxes Texas Scorecard

1747 Courtland Dr Frisco Tx 75034 Realtor Com

11260 Santa Maria Rd Frisco Tx 75035 Mls 20163953 Redfin

5961 Haverhill Ln Frisco Tx 75033 Realtor Com

7086 Barefoot Dr Frisco Tx 75036 Realtor Com

3 Stonebriar Way Frisco Tx 75034 Realtor Com

What Investors Should Know About Dallas Fort Worth Property Tax Rates